- Home

- Interview Question

- _C# Interview Q

- _Python Interview Q

- _PHP Interview Q

- _ASP .Net Interview Q

- _Core Java Interview Q

- Services

- _Software Download

- __Windows Download

- __Visual Basic Download

- __SQL Server Download

- __MySQL Download

- __Postman Download

- _ShortCodes

- Latest Post

- Jobs

- Documentation

- _Final Year Project

- __Banking System in C++

- __Student Module in C#

- __Online Exam in PHP

- _API Documentation

Post Top Ad

Random Posts

Popular Posts

Tags

- .Net Programs

- BackgrpundWorker

- C-Sharp

- C#

- C# DateTimePicker Control

- ColorDialog in C#

- ComboBox in C#

- Cookies in ASP.NET - C# Tutorials

- Csharp

- Cursors in C#

- Data Type in C#

- DataAdapter in C#

- DataGridView Control in C#

- DataReader in C#

- DataSet in C#

- DataTable in C#

- DataView in C#

- DomainUpDown in C#

- Error Provider in C#

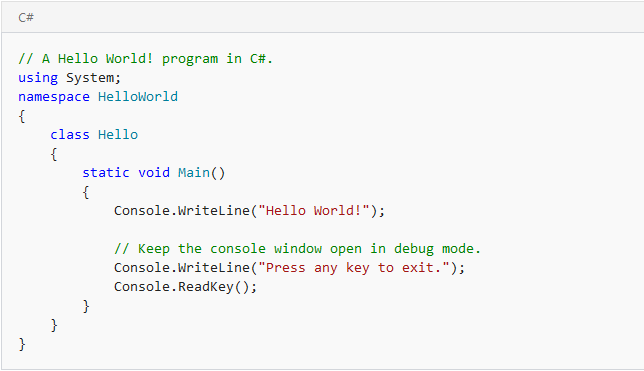

- First Program in C#

- FolderBrowserDialogSampleInCSharp

- FontDialog in C#

- Free Activation MS Office and Windows Activation KMSpico Download Link

- GroupBox in C#

- HelpProvider in C#

- Horizontal ScrollBar in C#

- How do you round a number to two decimal places in C#?

- How to convert a DateTime object to a string in C#

- How to make an HTTP POST web request using C# - RestSharp (Airpay Payment Gateway)

- How to show a progress bar while uploading file with file

- How to show progress bar with file size status while uploading file in C# Asp.net and Ajax

- If c#.net application contains main method now we can generate DLL file or not

- impinj rfid API in MVC C#

- Insert

- Label in C#

- Learn Online

- mageList in C#

- MaskedTextBox in C#

- MenuStrip in C#

- Merge Sort Algorithm In C#

- Message Box in Windows Forms using C#

- Notify Icon in C#

- NumericUpDown in C#

- operators in c language

- operators in c#

- operators in csharp

- Programs for printing pyramid patterns in C++

- Quick Sort Algorithm In C#

- Show Progress Bar While Uploading Files Using AJAX

- Software

- Sonu Yadav

- Update and Delete Records in a C# DataGridView

- Upload file to ftp server using c# asp.net with API

- Visual Studio

- What are the operators that are executed from right to left in c#.net?

- Working with Windows Forms FlowLayoutPanel

Sponsor

How I Saved ₹50,000 in 3 Months – Easy Tips

💰 Saving money sounds difficult, but trust me—it’s possible if you plan smartly. In just 3 months, I managed to save ₹50,000 without cutting off the things I love. Here’s how I did it, and you can too.

1. Track Every Rupee You Spend

Before saving, I had no idea where my money was going. I started using a budgeting app (Walnut / Money Manager) to track daily expenses. Within a week, I realized I was wasting almost ₹5,000/month on food delivery & impulse shopping.

👉 Tip: Write down every expense—even if it’s just ₹20 for chai.

2. Cut Down on Subscriptions

I had 3 OTT subscriptions + a gym membership I barely used. I kept only Netflix and switched gym to a local fitness center. Result? Saved ₹2,000/month instantly.

👉 Tip: Audit your subscriptions and keep only the ones you truly use.

3. Cook at Home & Limit Online Orders

Earlier, I was ordering food almost 4–5 times a week. I switched to meal-prepping at home and treated online food as a weekend reward. This alone saved me ₹6,000–₹7,000 per month.

4. Set Automatic Savings

I created a separate bank account and set an auto-transfer of ₹15,000/month right after salary credit. Out of sight, out of mind. Within 3 months, I had ₹45,000 without even realizing.

👉 Tip: Automate savings—it forces discipline.

5. Smart Shopping Hacks

-

Wait for sales instead of impulse buying

-

Use cashback apps (CashKaro, PayTM offers)

-

Buy essentials in bulk (rice, oil, toiletries)

These hacks saved me ₹3,000–₹4,000 extra.

Final Results 🎯

-

Money Saved: ₹50,000 in 3 months

-

Lifestyle Sacrificed? No. Just smarter decisions.

💡 Takeaway: Saving is not about living cheap—it’s about living smart. Start small, track your expenses, and you’ll be surprised at how much you can save.

Translate

Interior Design Blogs

Follow Us

Popular Posts

Search This Blog

Post Bottom Ad

Contact Form

Pages

- Home

- Core Java: Interview Questions and Answers

- Student Management System Project in C# .Net

- Banking System Project in C++

- PHP Online Examination System

- ASP.Net Interview Questions & Answers

- PHP Interview Questions

- Python interview questions

- C# Interview Questions and Answers

- Jobs

- Software Download

Comments

Total Pageviews

Random Posts

Categories

Tags

Popular Posts

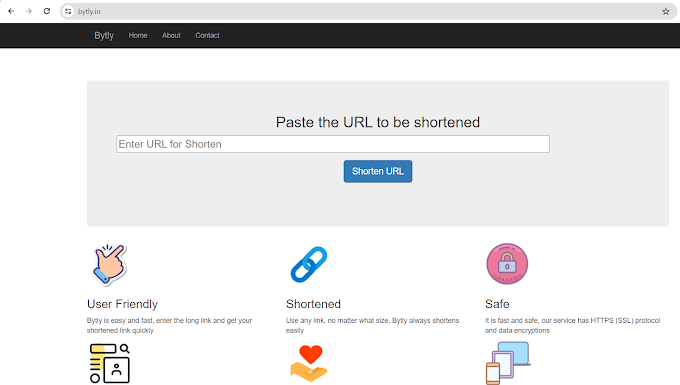

Bytly: Free Shorten URL Website

0 Comments

Thanks for Commenting on our blogs, we will revert back with answer of your query.

EmojiThanks & Regards

Sonu Yadav